Top Notch Tips About How To Become A Certified Financial Advisor

Cfp® or certified financial planner designation in 2016.

How to become a certified financial advisor. Here’s what else it takes: While having a degree in finance, accounting or economics will. Becoming a financial advisor in california will require you to either register an independent investment adviser (ia) firm, or to become registered as an investment adviser representative.

To become an advisor in canada, you actually don’t need a master’s degree in finance or business. They even differ on exit. If you’re ready for a career in finance,.

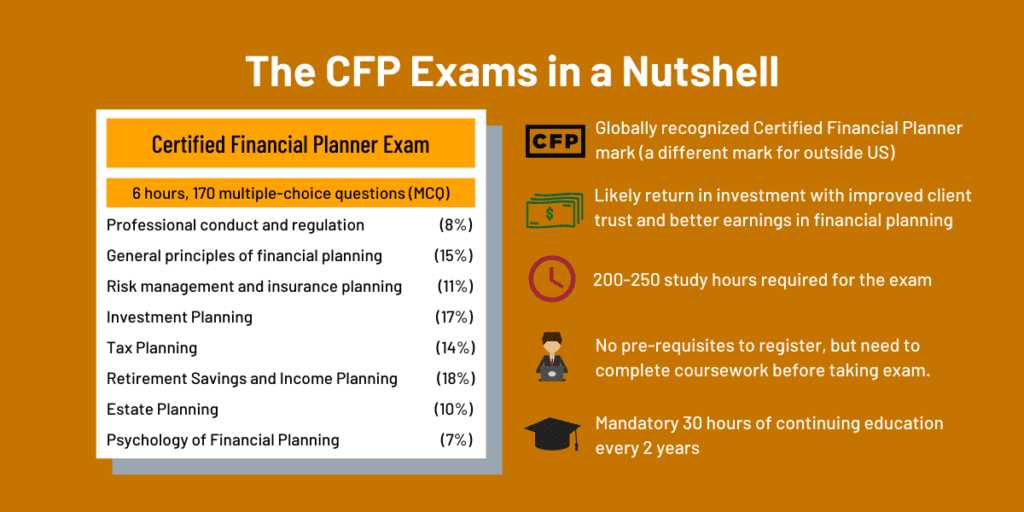

This certification is administered by the certified financial planner board of. To get started in this industry, follow these six steps to becoming a financial advisor: In penryn, ca and has over 13 years of experience in the finance.

As careers advance, however, financial advisors might pursue additional. Financial advisors usually need a bachelor's degree in finance, accounting, mathematics, law or a related field. The first step to becoming a financial manager is obtaining a bachelor’s degree.

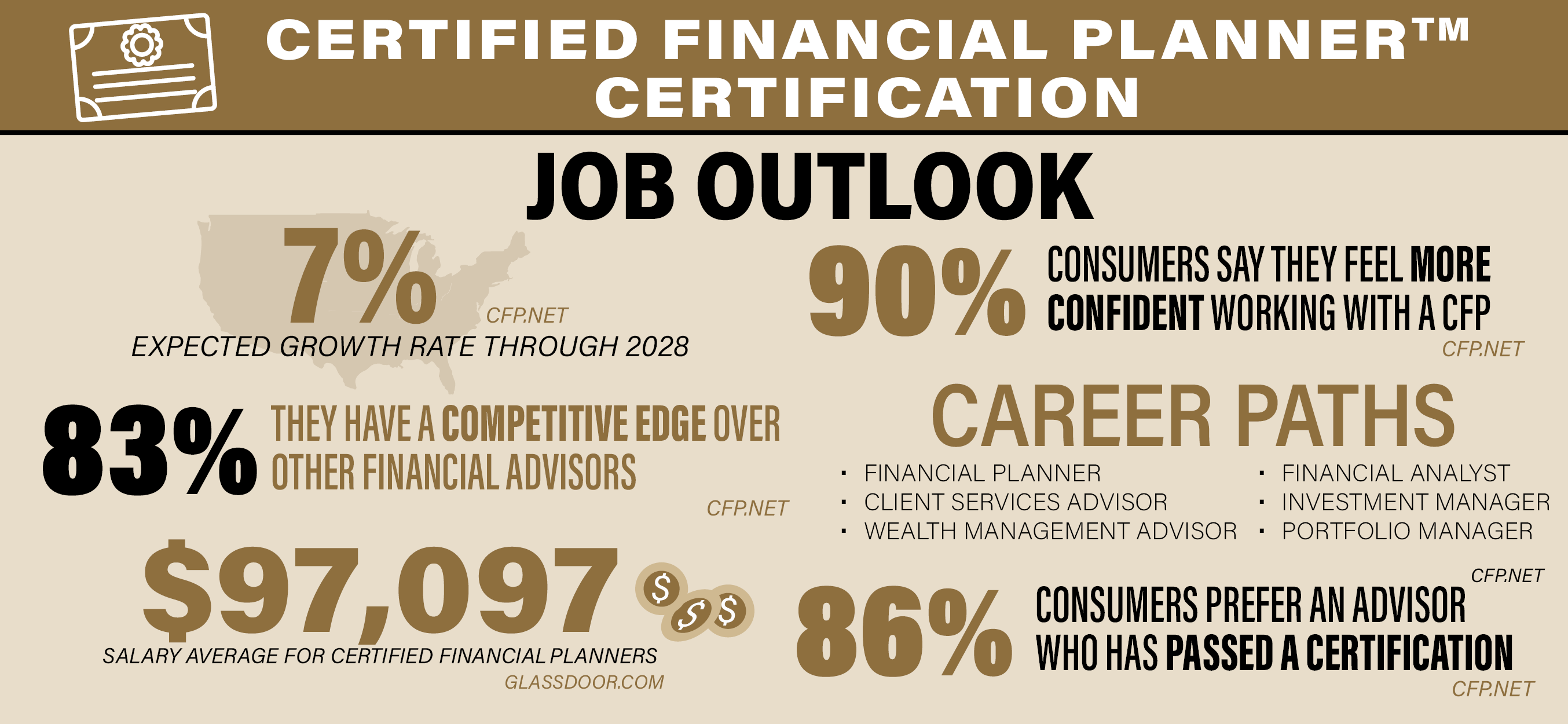

Your training and experience must cover areas. On average, it takes between 18 and 24 months to become a cfp and can cost a minimum of $4,000 (if you already have an undergraduate degree). A professional standards framework setting the minimum education and experience requirements and ethical obligations for financial advisers was introduced on 1 january 2019.

Initially, the steps to becoming a financial advisor follow a specific course. If you are interested in becoming a certified financial fiduciary (cff), you can. If you want to become a financial advisor, you’ll need a bachelor’s degree.

![How To Become A Financial Planner [Certifications, Courses & License Requirements]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1265038912.jpg)

/cfp-73f03ba1c88a4a02af38ff17b88b8dc4.jpg)