Fun Tips About How To Reduce Bank Charges

/GettyImages-87307795-004d8906af504ae09f158ce507dff064.jpg)

The bank that sends the money will charge a fee for doing so.

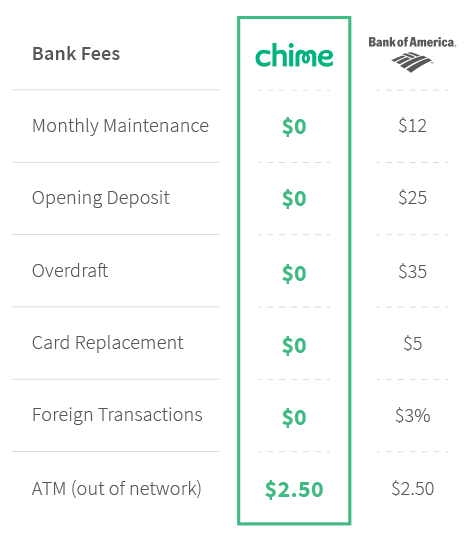

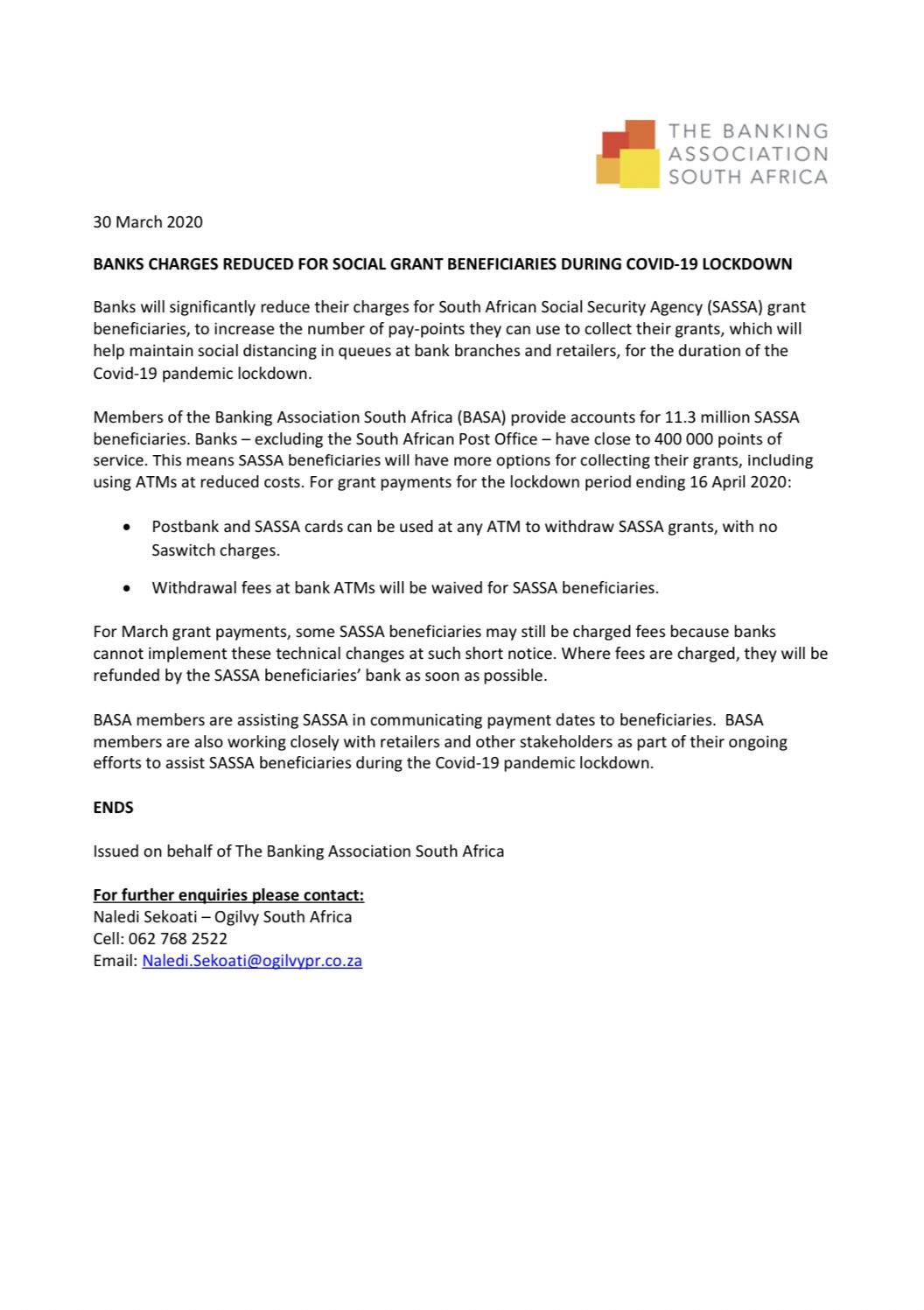

How to reduce bank charges. Banks have been digitizing their products, services, and processes over the past decade—a shift that was expected to reduce operating costs. However, it is quite possible to reduce your bank charges thanks to the strong competition in the market. When looking at other countries around the world, new zealand had some of the lowest bank transfer fees for international payments.

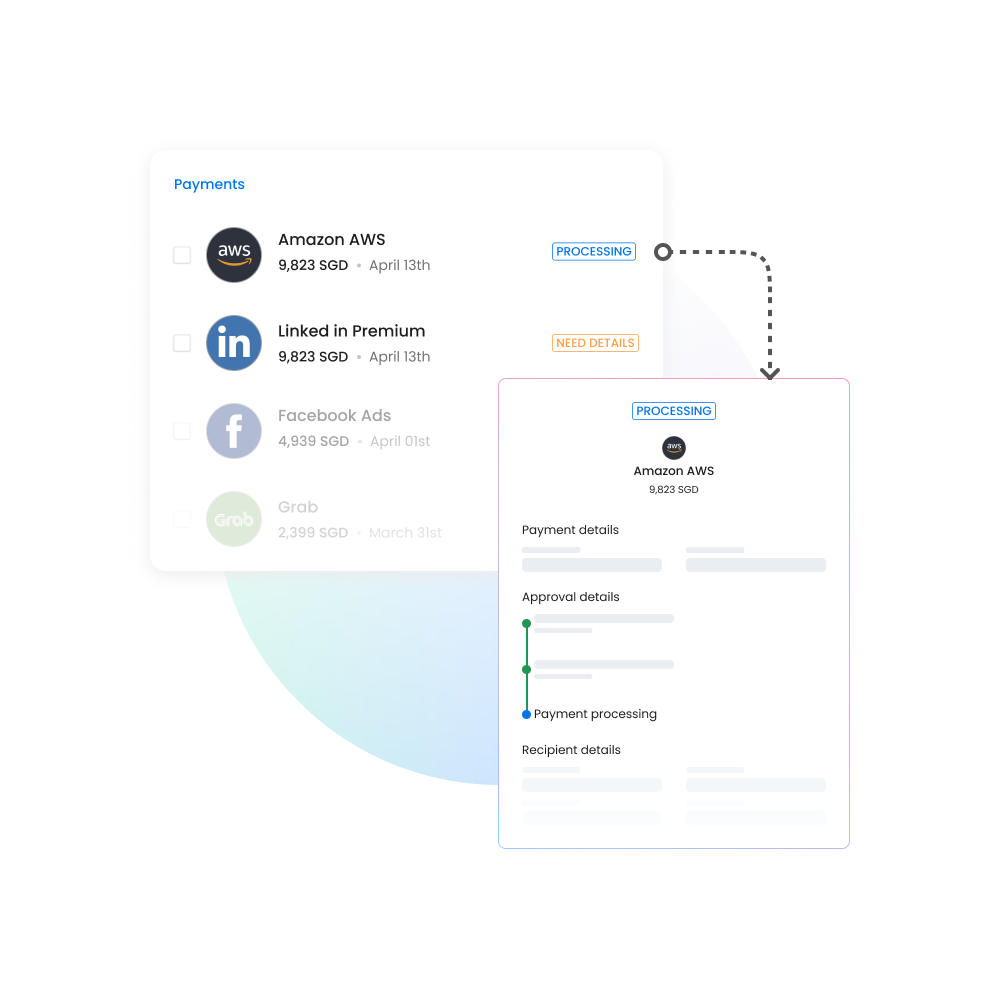

When you bring in a smart expense management system, you cut down your bank's indirect and hidden business banking fees. Where you do your physical banking makes a big difference to your banking costs. Many banks will waive checking account fees if you set up direct.

Bank online or via an app. When doing so with your card you. Reduce your transactions most banks charge per transaction, so the fewer transactions your business makes every month, the cheaper your bank fees will be.

However they will give you a choice: Review this list of 10 ways to avoid or reduce business banking fees for your small business. Here are 3 ways to reduce your fees:

$40 to $50 per wire transfer. 7 essential ways to avoid unnecessary bank charges 1. Before telling you how to avoid or reduce your bank charges, let's first introduce them.

Understand what your bank can charge. As you limit the transactions you make through your bank. So, if there are ways to reduce bank charges, take advantage of them as much as you can because, at the end of the period, such charges add up.